Description

Product Description

Product Description

Included is a Power Point and outlined note packet that is used to introduce taxes and government spending, as well as a review of monetary policy, and their influence on the Aggregate Supply and Demand graph to an on-level, honors, or AP level Macroeconomics course. Included are the following resources:

Included are the following topics:

1. Taxes

2. Government Spending

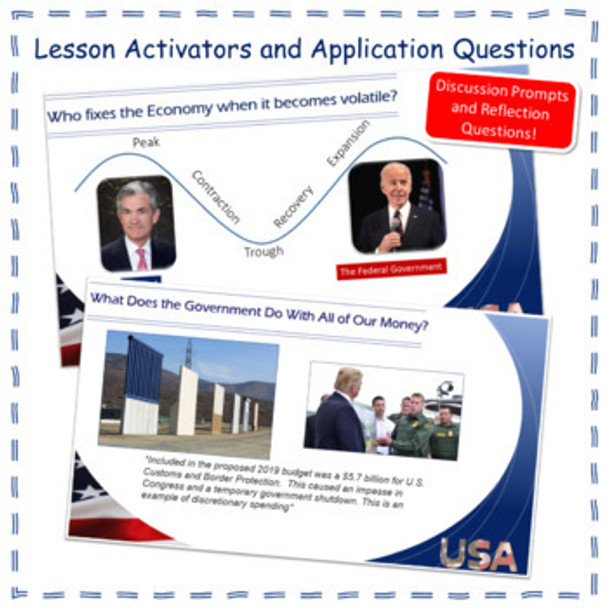

3. Multiplier Effect

4. Progressive Taxes

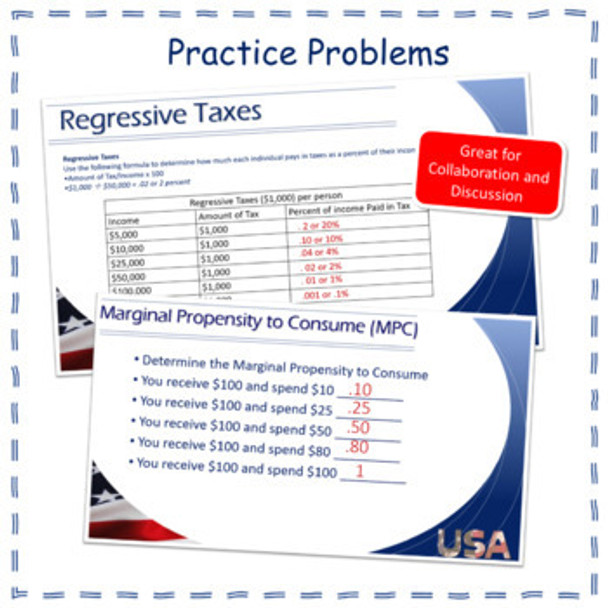

5. Regressive Taxes

6. Proportional Taxes

7. Fiscal Policy

8. Marginal Tax Rate

9. Budget Deficits and Surpluses

10. Marginal Propensity to Consume and Save

11. Spending and Tax Multiplier

Total Pages

82 pages

Answer Key

N/A

Teaching Duration

2 Weeks