Description

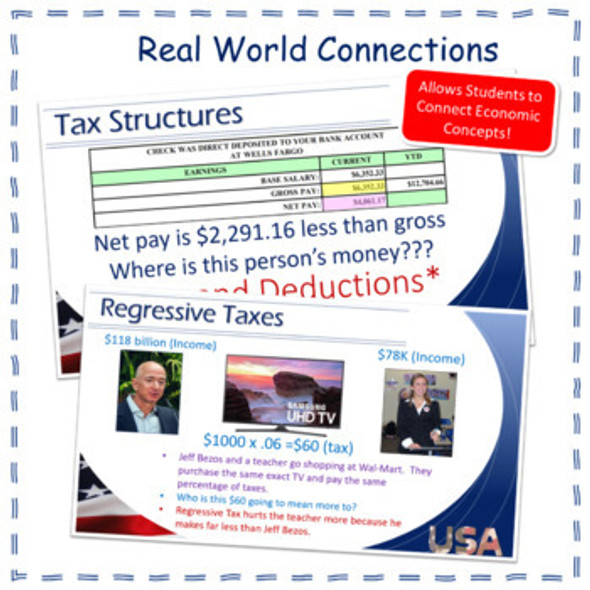

Are you looking for a bundle of tests, webquests, worksheets, that focus on taxes and government spending and more for a high school economics course? Included is a bundle that is used to introduce taxes and government spending, and a brief review of the impact of fiscal policy, and its influence on the Aggregate Supply and Demand graph to an on-level, honors, or AP level Macroeconomics course.

- This package is also designed to work for 1:1 or distance learning.

- All resources are in the Microsoft format, as well as a Google Suite option for teachers/students that utilize the Google Classroom.

Google Suite includes:

- Fillable Notes Google Docs

- Fillable Notes using Google Slides

- Google Slides Powerpoint

Microsoft Suite includes:

1. Power Point

2. Note Packet (used to supplement the PPT)

Included are the following topics:

1. Taxes

2. Government Spending

3. Multiplier Effect

4. Progressive Taxes

5. Regressive Taxes

6. Proportional Taxes

7. Fiscal Policy

8. Marginal Tax Rate

9. Budget Deficits and Surpluses

10. Marginal Propensity to Consume and Save

11. Spending and Tax Multiplier